In 2017, Tommy Lee forecasted #Bitcoin would cross the $100,000 mark.

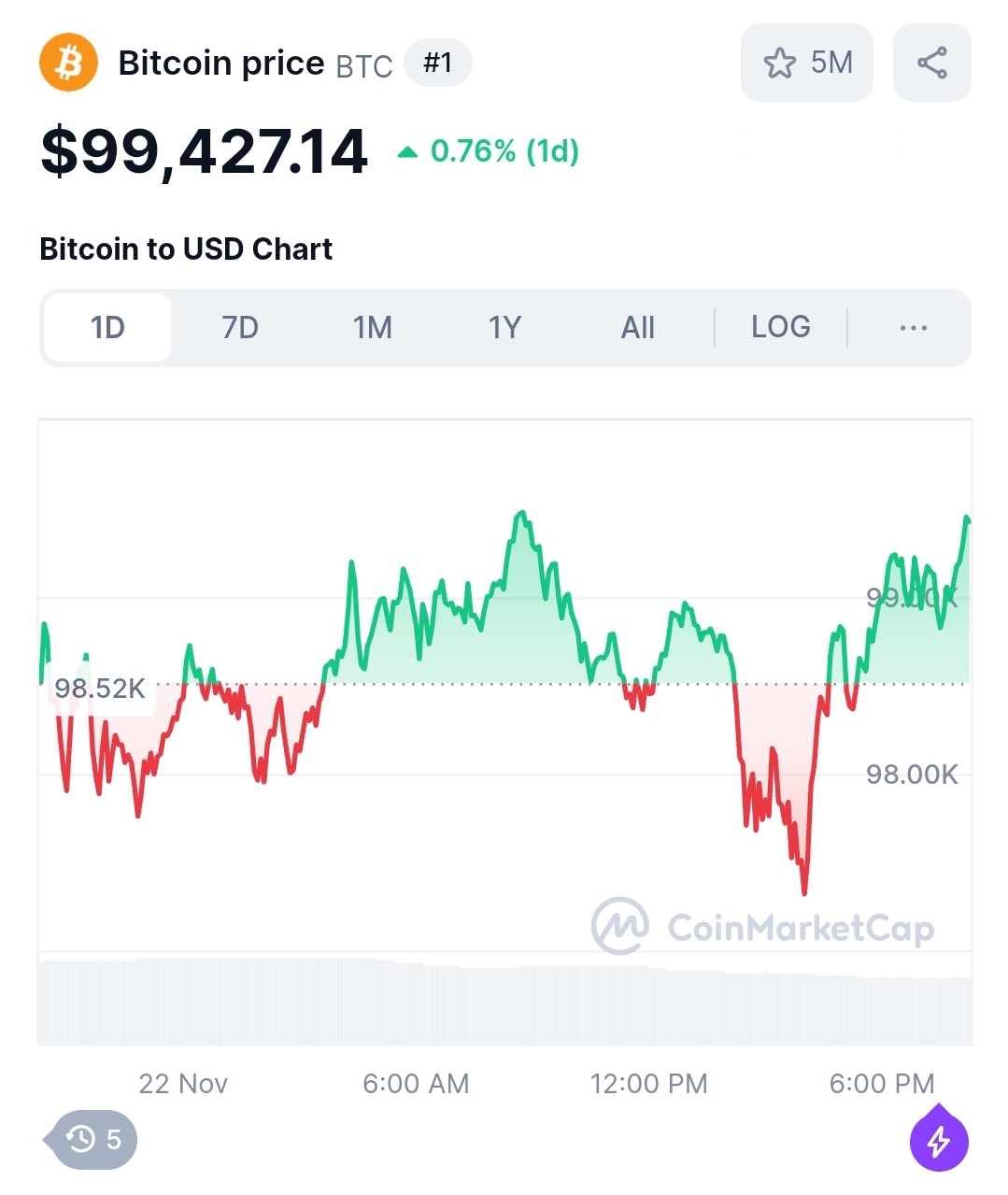

I received an alert: “Bitcoin reaches a new all-time high of $99,261 USD. This is an increase of +47.64% since last month.”

Whether you believe in #cryptocurrencies or not isn’t the point. The point is you must understand what they are and what they represent to make the right decision and fall into the trap of FOMO (fear of missing out).

Contextual Knowledge:

- Bitcoin is both a cryptocurrency and the name of its underlying #Blockchain network

- To hold Bitcoin, you need a Bitcoin wallet or an online service that manages the wallet (though technically, you aren’t the direct owner)

- You can transact in Bitcoin via your wallet or a Bitcoin Visa Card

- Bitcoin is considered “digital #gold” – a store of value that historically outperforms other asset classes, with an average yearly return of approximately 182%

- Bitcoin’s volatility is unparalleled: -64.3% in 2022, +155.4% in 2023

- Bitcoin #ETF (or ETP in Europe) represents the traditional finance-approved version. In 2023, #Blackrock issuing a Bitcoin ETF did send a strong signal

- Some businesses are diversifying investments through Bitcoin, with #MicroStrategy holding approximately 331,200 bitcoins as a strategic asset

- El Salvador has adopted Bitcoin as its official national currency

Why the current boom?

President Donald Trump, known as a “pro-crypto” leader, has been making strategic moves. After issuing two #NFT collections in 2022 and 2023, he launched “The Defiant Ones” #DeFi platform with his sons Eric and Donald Jr. Trump.

Furthermore, he appointed Elon Musk as co-head of the Department of Government Efficiency (note the playful D.O.G.E. acronym).

Musk, notorious for supporting the #Dogecoin community, has seen the cryptocurrency soar by 193.44% in a month, with a pivotal moment on November 5th, 2024 – the US election day.

Markets aren’t always rational, but the sequence of events always tells a story.

Golden Rule: If you do not understand the product, do not invest.

In #tech we trust.

🫡